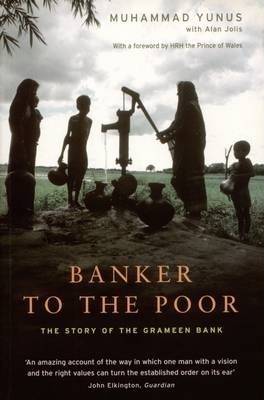

What is the first thing in your mind about a bank that is lending money without collateral? The story of the Grameen Bank is inspiring for many because it brought many people out of poverty through micro-credit and made us re-think how the banking should work for the bottom of the pyramid.

Muhammad Yunus, the founder of the Grameen Bank, who won the Nobel Peace Prize through his work with the Grameen Bank, shared his story in this book. Starting from his early childhood in Bangladesh, his adventure of going to abroad to earn a doctorate degree, his involvement in Bangladesh independence, to the founding of the Grameen Bank.

The book detailed on how micro-credit, could be used to improve the living conditions of the poor and eradicate poverty.

Unless we create an environment that enables us to discover the limits of our potential, we will never know what we have inside of us.

The Grameen Project started at the University of Chittagong in Bangladesh, where Muhammad Yunus was an economic professor. During his tenure at the university, he conducted a study with his students to understand poverty by going door to door.

Prof. Yunus figured that poverty is like a cancer, once a person got into poverty, it’s very difficult (or almost impossible) to get out. A poor person would work very hard, and would only earn so little (approximately 2 cents) to scrap food for the day. The next day, the poor person would repeat the same exact work, and the cycle would just keep repeating.

Why would a person work very hard, and earn so little? Because a free market isn’t available for the poor. Instead of selling their goods for a higher profit in the open market, they are forced to sell their goods to the shark money lenders who gave them the capital at a very high interest rate (as high as 10% per week). The money lender would pay so little to make sure that the poor who borrowed money from them are kept in the poverty cycle, so that they could keep getting goods at a very low rate.

Usually the borrower will have to borrow again just to repay the prior loan, and ultimately the only way out is death.

Looking at this situation, Prof. Yunus heart was moved and lent $27 to 42 poor people. The $27 allows them to pay back their previous loan, and provided capital for their work that they could sell in the open market at a higher rate. In addition with getting them out of the poverty cycle, all 42 people pay back the $27 to Prof. Yunus.

From this experience, Prof. Yunus thought of institutionalizing this model to solve poverty in Bangladesh. There are many challenges of starting the Grameen Bank, both culturally and politically. There were push backs from the religious leaders in certain villages where the Grameen tried to enter with an idea that the Grameen is a Christian organization with a goal to convert the religion of the people in the village.

There were also push backs from the national banks incumbents with various skepticism. They thought that the micro-credit model that the Grameen introduced would be very expensive and wouldn’t work economically. Prof. Yunus proved them wrong by replicating the model in multiple cities in Bangladesh with a very high repayment rate (about 99.8% at the time).

Grameen is like my mother. No, Grameen is not like my mother, she is my mother. She has given me new life.

The Grameen loan gives an opportunity for the poor to start a micro business. Whether it’s making a bamboo baskets, or farming rice paddies, or sewing clothes, the loan provided a capital for the poor to get started, which would otherwise be going to a loan shark. The traditional bank wouldn’t lend them money because they don’t have any assets for collateral.

The first loan is about $12 to $15, and this is the biggest amount of money that many of the Grameen’s clients have ever hold in their life. It is interesting when the book described the experience of people receiving the money for the first time. Some were very nervous when the money was handed out. Many couldn’t sleep the night prior to getting the money, and some kept thinking to bail on the day they were suppose to be getting the money because of the cultural push backs.

We discovered that the formation of a group was crucial to the success of our operations.

group membership creates group support and group pressure and smoothes out behaviour patterns and makes the borrower more reliable.

if any member of the group ever gets into trouble, the group usually comes forward to help out.

The mechanics of the loan and its re-payment process is only briefly described in the book. The idea is a borrower needs to be part of a peer support group, who would have a regular meeting. A group is about 5 people with similar economic situations. The peer support group also have regular meeting with the group centers. The group centers consist of multiple peer support group with a representative from the bank. A representative from the bank would go to 10 different centers a week.

The peers influence in the group is very strong because when a member defaulted a loan, no one in the group could get a loan. In practice, everyone in the group is making sure every members in the group pay back their loans.

The Grameen loan is not simply cash, it becomes a kind of ticket to self-discovery and self-exploration.

The borrower begins to explore her potential, to discover the creativity she has inside her.

I would say that with Grameen’s two million borrowers, you get two million thrilling stories of self-discovery.

The micro-credit model that the Grameen Bank introduced gave an opportunity for the poor to get out of poverty by providing a very small amount of capital to start a micro business.

Conventional banks have built their credit institution on the base of distrust. But for Grameen ‘credit’ means ‘trust’.

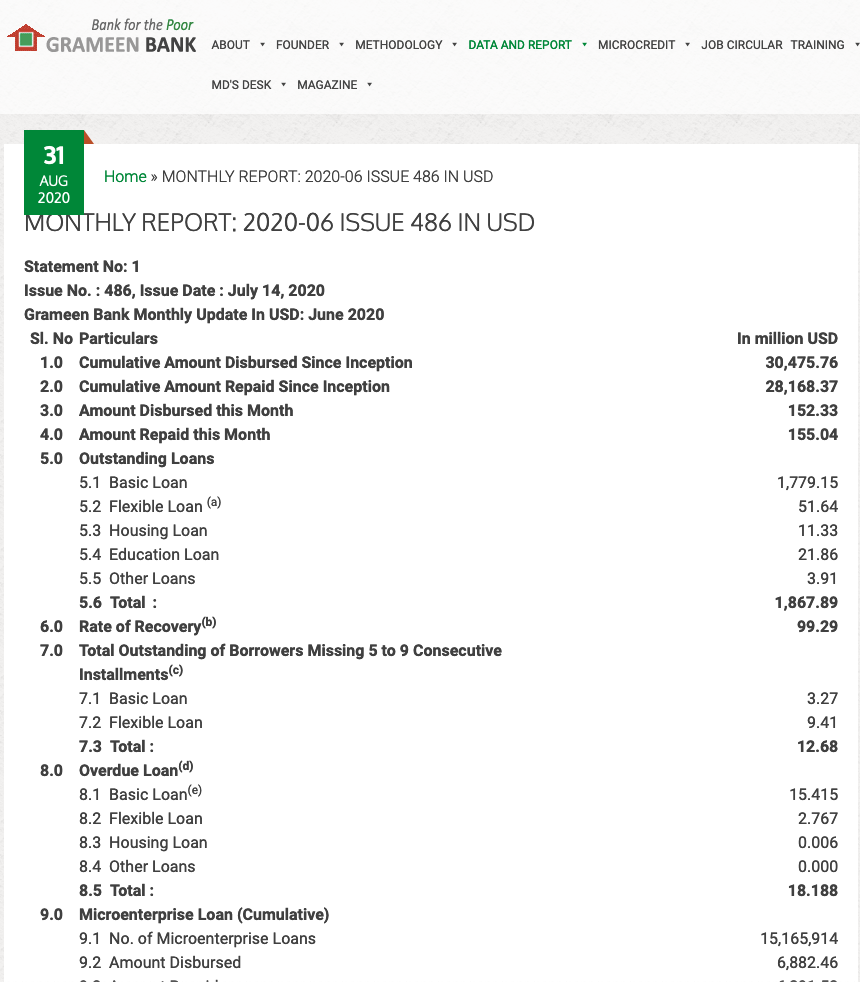

As of July 2020, the Grameen Bank has disbursed $30 billion of loans with 99.2% recovery rate.

There are some articles and case studies who argued the definition of recovery rate that is used by the Grameen Bank isn’t the same as the traditional bank because they automatically converts the basic loan to a flexible loan when it doesn’t get repaid.

Today, the Grameen Project has been replicated in various parts of the world.

I’ve also included the case study from the Columbia University on the Grameen Bank, which is an interesting read to understand the economics of the Grameen Bank’s micro-credit model.